Rumored Buzz on Estate Planning Attorney

Rumored Buzz on Estate Planning Attorney

Blog Article

Indicators on Estate Planning Attorney You Need To Know

Table of ContentsGet This Report about Estate Planning AttorneySome Of Estate Planning AttorneyThe Ultimate Guide To Estate Planning AttorneyRumored Buzz on Estate Planning Attorney

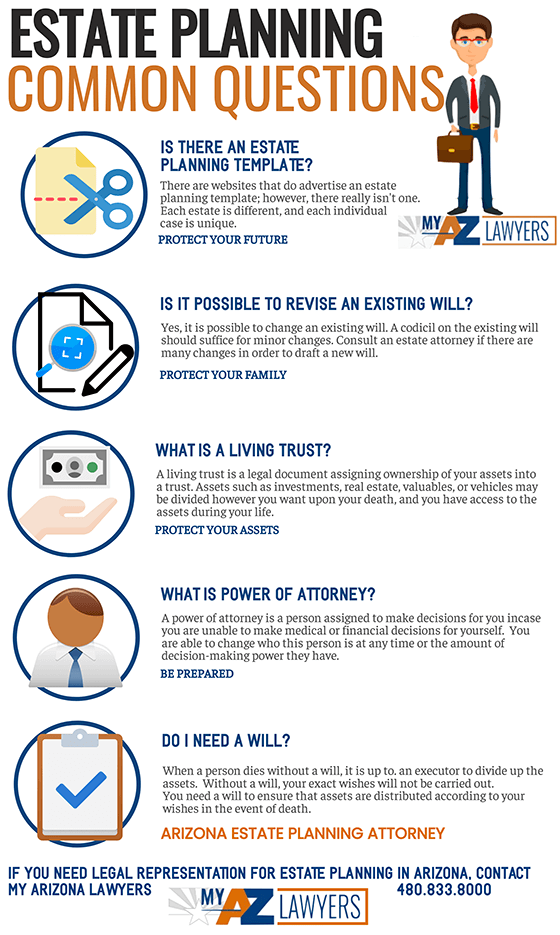

Estate planning is an activity strategy you can make use of to determine what occurs to your properties and obligations while you're alive and after you die. A will, on the other hand, is a lawful record that describes exactly how properties are dispersed, that deals with children and family pets, and any kind of other wishes after you die.

Insurance claims that are rejected by the executor can be taken to court where a probate court will certainly have the final say as to whether or not the claim is legitimate.

Fascination About Estate Planning Attorney

After the inventory of the estate has been taken, the value of assets calculated, and taxes and financial obligation settled, the administrator will then seek permission from the court to distribute whatever is left of the estate to the beneficiaries. Any type of inheritance tax that are pending will come due within nine months of the date of death.

Each individual places their assets in the count on and names somebody other than their spouse as the beneficiary., to sustain grandchildrens' education.

Fascination About Estate Planning Attorney

This technique entails freezing the worth of an asset at its worth on the date of transfer. Appropriately, the amount of prospective resources gain at death is additionally frozen, enabling the estate organizer to estimate their possible tax obligation upon fatality and better strategy for the settlement of earnings tax obligations.

If sufficient insurance policy proceeds are offered and the plans are properly structured, any type of revenue tax on the deemed personalities of properties complying with the fatality of an individual can be paid without resorting to the sale of possessions. Profits from life insurance that are gotten by the recipients upon the death of the guaranteed are normally revenue tax-free.

There are specific papers you'll require as component of the estate preparation procedure. Some of the most usual ones consist of wills, powers of lawyer (POAs), guardianship classifications, and living wills.

There is a misconception that estate preparation is just for high-net-worth people. But that's not true. Estate preparation is a device that everyone can use. Estate preparing makes it easier for individuals to establish their dreams before and after they die. Contrary to what many people think, it expands beyond what to do with assets and liabilities.

Estate Planning Attorney Fundamentals Explained

You should begin intending for your estate as soon as you have any kind of measurable possession base. It's an ongoing procedure: as life proceeds, your estate plan need to shift to match your scenarios, in line Recommended Site with your brand-new goals.

Estate preparation is usually thought of as a tool for the rich. Estate preparation is additionally a wonderful way for you to lay out plans for the care of your minor kids and try here pet dogs and to detail your dreams for your funeral service and favorite charities.

Qualified candidates who pass the examination will certainly be officially accredited in August. If you're qualified to sit for the examination from a previous application, you might submit the short application.

Report this page